Moomoo Fund Plus

Grow Potential Wealth Invest for Your Future

Subscribe Now

Moomoo Fund Plus

Grow Potential Wealth Invest for Your Future

Subscribe Now

150+ Funds from

30+ Top Fund Houses Worldwide

Why Moomoo Fund Plus?

Thoughtfully Curated

Wide coverage

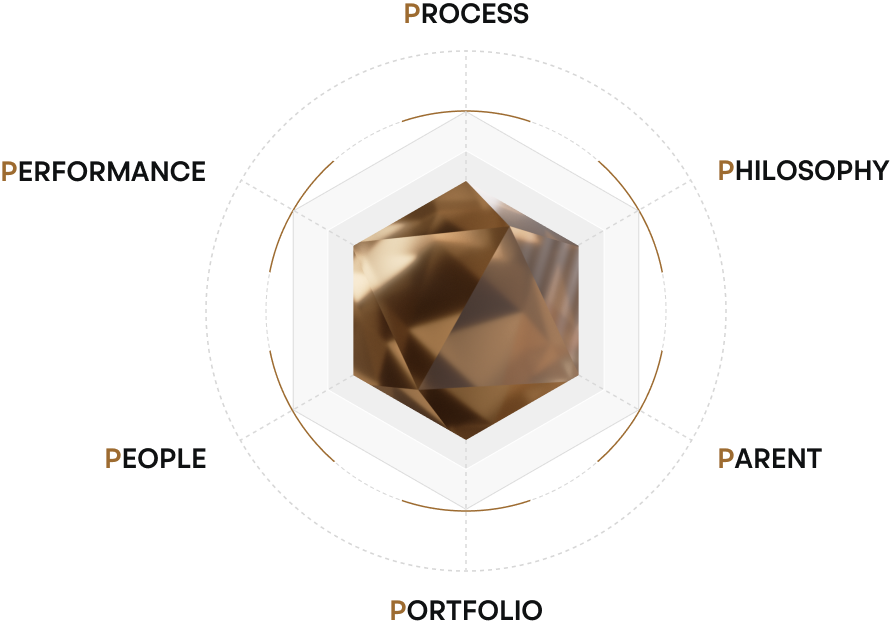

Multi-dimensional decision making

0 Fee^

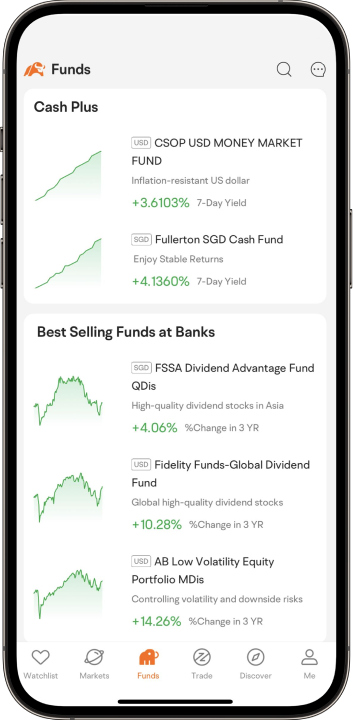

70+ global strategies

20+ Asian strategies

20+ U.S. strategies

15+ countries (regions) Products.

Each fund is curated based on the 6Ps of fund selection: performance, philosophy, portfolio, people, parent, and process

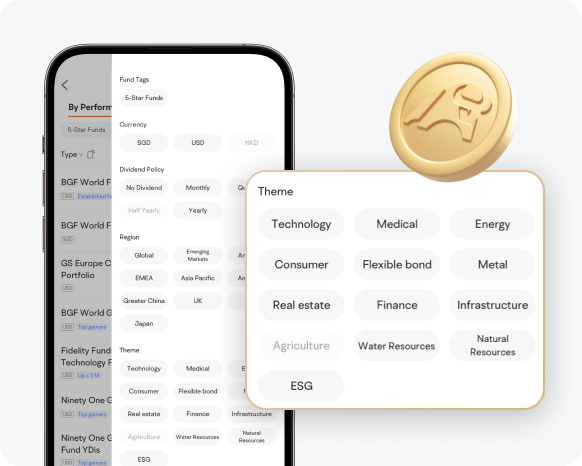

Strategies are spread across the globe, with a wide selection of investment sectors and themes to choose from. With just one app, you can invest globally at home and further filter sectors of interest.

Analyze and screen

Theme Screening

Moomoo offers self-built trading systems for online trading, reducing labor costs and transaction fees than in the traditional trading model.

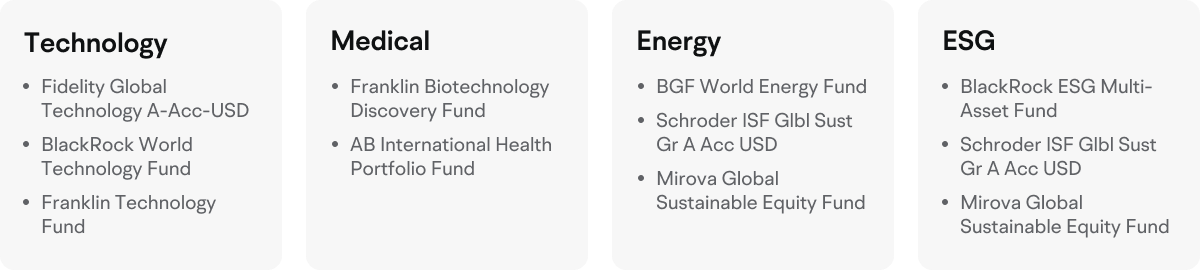

Technology 9, real estate 8, energy 5, ESG 5, more than 10 industry products.

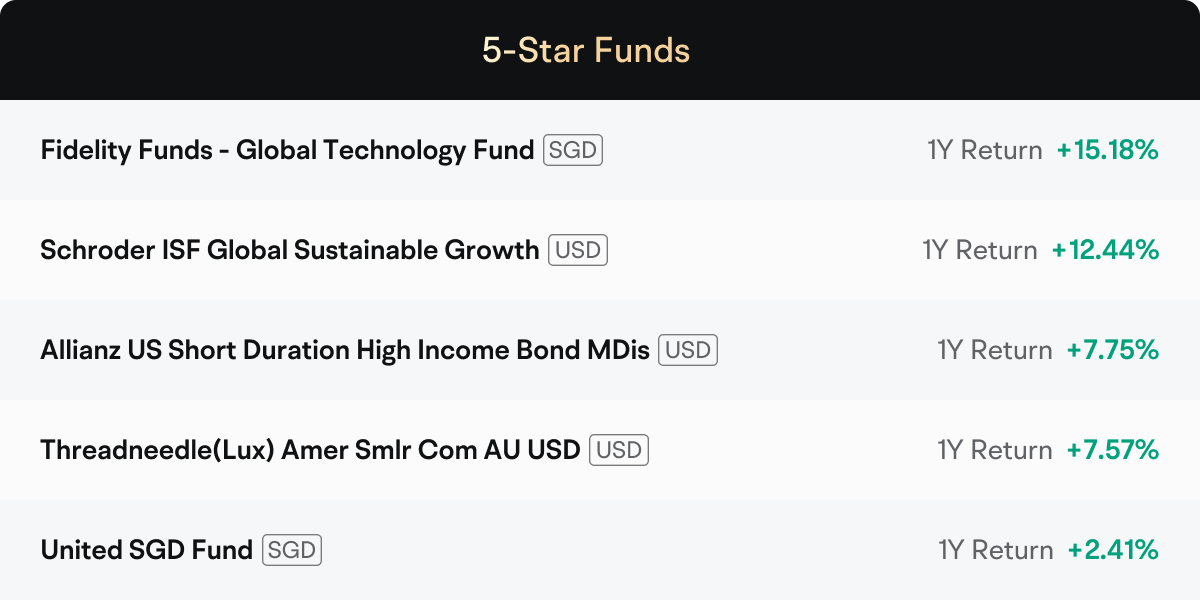

Over 90% of funds with Morningstar ratings of three, four or five stars.

Data source: Morningstar,data as of 12/09/2023

Note:Number of funds is accurate as of 12/09/2023. Above list is not exhaustive. Please refer to our moomoo app for more information.

^ Management fee is charged by the fund company which are included in the NAV calculation.

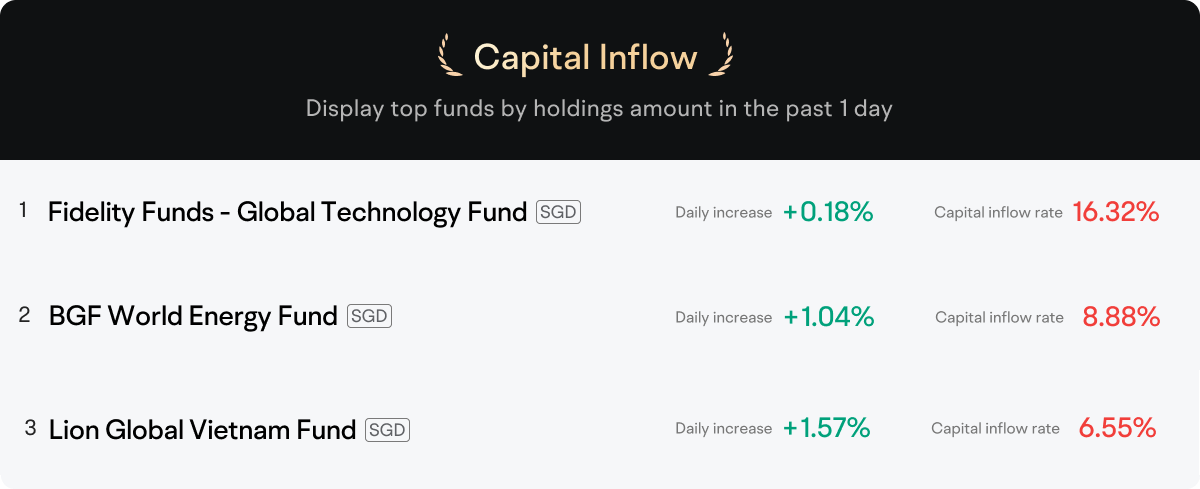

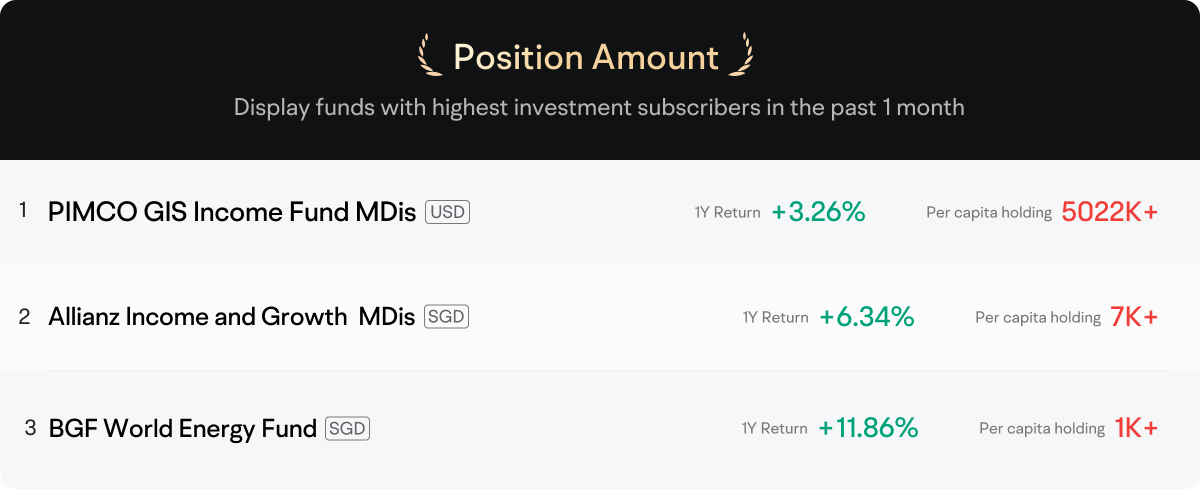

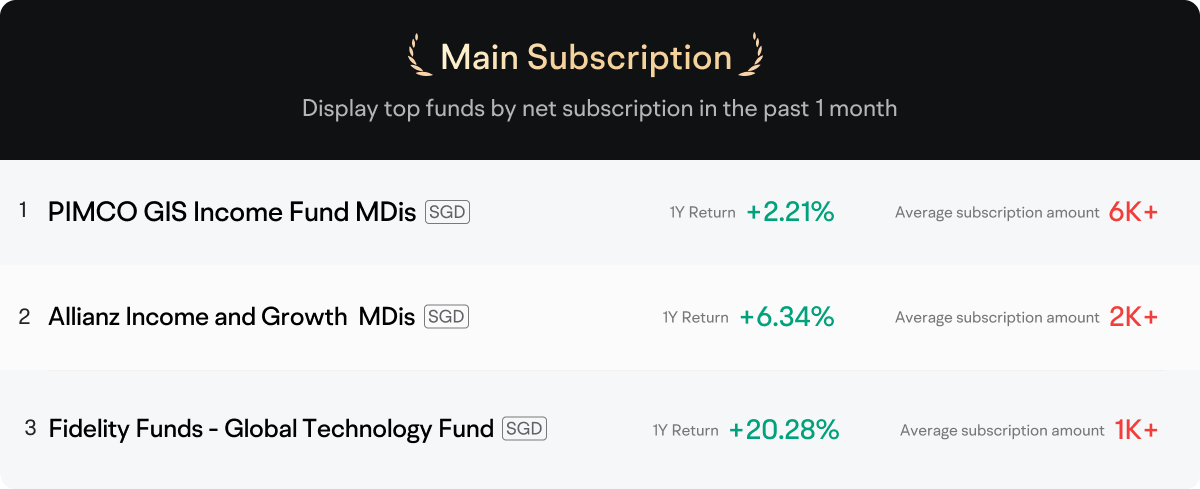

Note: The above rankings are based on Moomoo SG and public data as of 6 September 2023. Past performance is not indicative of future returns.

Better understand the relevance of hotspots and your own

Find the target theme faster

Click to download the app for more >

Better understand what people are buying

Data screening

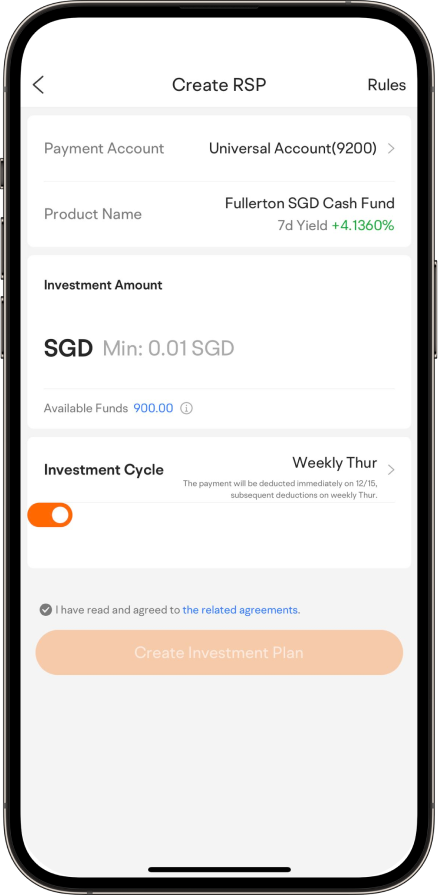

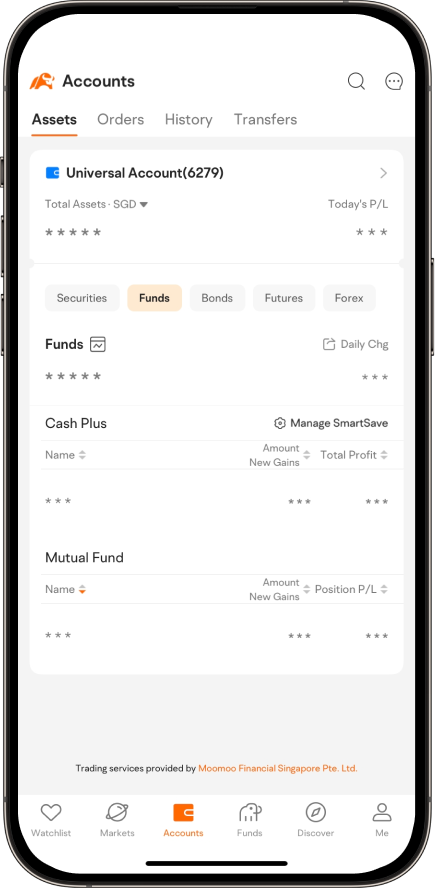

4 steps to start the road to wealth growth

Register for a Moomoo SG universal account and bind your bank account

Select the fund that suits your needs

Deposit funds through your linked bank account

Monitor your investment returns

Futu Holdings Limited ("Futu") (Nasdaq: FUTU) is an advanced fintech company upgrading the investing experience by offering fully digitalized financial services in multiple markets. It's subsidiaries covers Hong Kong, the United States and Singapore, and has become one of the world's leading online securities trading platforms.

Users cover over 200 countries and regions, with 1.2 million daily active users. As of 2023x, Fortune Group's wealth management assets exceeded HK$50 billion, with win-win cooperation with 30+ top fund companies.

© 2024 moomoo

Note: Data as of 2023 Q1 financial report data and public market data

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services available through the moomoo app are offered by Moomoo Financial Inc., a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC). In Singapore, investment products and services available through the moomoo app are offered through Moomoo Financial Singapore Pte. Ltd. regulated by the Monetary Authority of Singapore (MAS). This advertisement has not been reviewed by the Monetary Authority of Singapore. In Australia, financial products, and services available through the moomoo app are provided by Futu Securities (Australia) Ltd, an Australian Financial Services Licensee (AFSL No. 224663) regulated by the Australian Securities and Investment Commission (ASIC).

No content herein shall be considered an offer, solicitation or recommendation for the purchase or sale of securities, futures, or other investment products. All types of investments are risky and investors may suffer losses. All information and data on the website are for reference only. Past performance does not guarantee future results. This promotion does not take into account your investment objectives, financial situation or financial needs. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Disclaimer